Qualified borrowers have access to one of the most straightforward and powerful VA refinance options around: the VA Interest Rate Reduction Refinance Loan (VA IRRRL), also known as a VA Streamline refinance.

VA Streamline refinance loans are relatively easy and can be completed quickly because homeowners are refinancing from one VA loan product to another.

What is a VA IRRRL (Streamline Refinance)?

A VA IRRRL, pronounced as “VA earl,” is a mortgage refinance option for Veterans with an existing VA loan. The IRRRL works by allowing eligible homeowners to refinance an existing VA loan to a new VA loan with a lower interest rate or more stable terms, such as converting from an adjustable-rate to a fixed rate.

It's often called a VA Streamline refinance because it generally requires less time and paperwork than other refinance options.

VA IRRRL Rates Today

The typical reason many Veterans refinance is to lower their current mortgage's interest rate. IRRRL rates may vary from home purchase rates and change daily based on market conditions. See current VA IRRRL rates below.

Current VA IRRRL Rates

| VA Loan Type | Interest Rate | APR | Points |

|---|---|---|---|

| 30-Year Streamline (IRRRL) Refinance | 5.375% | 5.665% | 1.7500 ($5162.50) |

| 30-Year Streamline (IRRRL) Jumbo Refinance | 5.990% | 6.176% | 0.5000 ($3832.76) |

When refinancing, the difference in rate or terms must be enough to provide tangible benefits, such as lower monthly payments or a fixed interest rate instead of an adjustable one.

Every VA refinance situation is different. Talk through your specific situation with a Veterans United VA loan expert who can run the numbers and help you gauge what makes the best financial sense.

30-Year VA IRRRL Rate Trends

Understanding historical trends for VA IRRRL rates can show how interest rates have shifted recently and help you identify the best time to refinance your VA loan.

Check out how 30-year fixed VA IRRRL rates have shifted over the past three months compared to conventional refinance rates.

30-Year Fixed VA IRRRL Weekly Averages Rate Trends

The charts on this page show the average available VA loan rates for IRRRL and conventional refinance loans from Veterans United for each week listed. Not all consumers received this average rate and all eligibility for rates is based on individual factors including credit score.

VA Streamline Refinancing Benefits

With an IRRRL, there are several prominent advantages, including little to no out-of-pocket costs and no VA appraisal in most instances.

To avoid out-of-pocket costs, homeowners can choose to roll the closing costs and fees into the loan balance.

With a reduction of just 0.5%, a borrower could potentially generate tens of thousands in savings over the life of a loan.

Let's look at a quick example using the same loan terms (30-year, fixed rate) with three different interest rates.

| Example | Monthly Estimated Principle & Interest Payment | Total Estimated Interest Paid Over 30 Years |

|---|---|---|

| $250,000 loan at 7.5% interest rate | $1,748 | $379,293 |

| $250,000 loan at 7% interest rate | $1,663 | $348,772 |

| $250,000 loan at 6.5% interest rate | $1,580 | $318,861 |

Savings and interest rates shown here are for illustrative purposes only and may change based on a variety of factors. All loans require approval and proof of eligibility and are subject to the complete terms and conditions outlined in the loan agreement documents.

Want to see what you could save with a VA refinance? Estimate your savings and monthly payments with our VA loan refinance calculator.

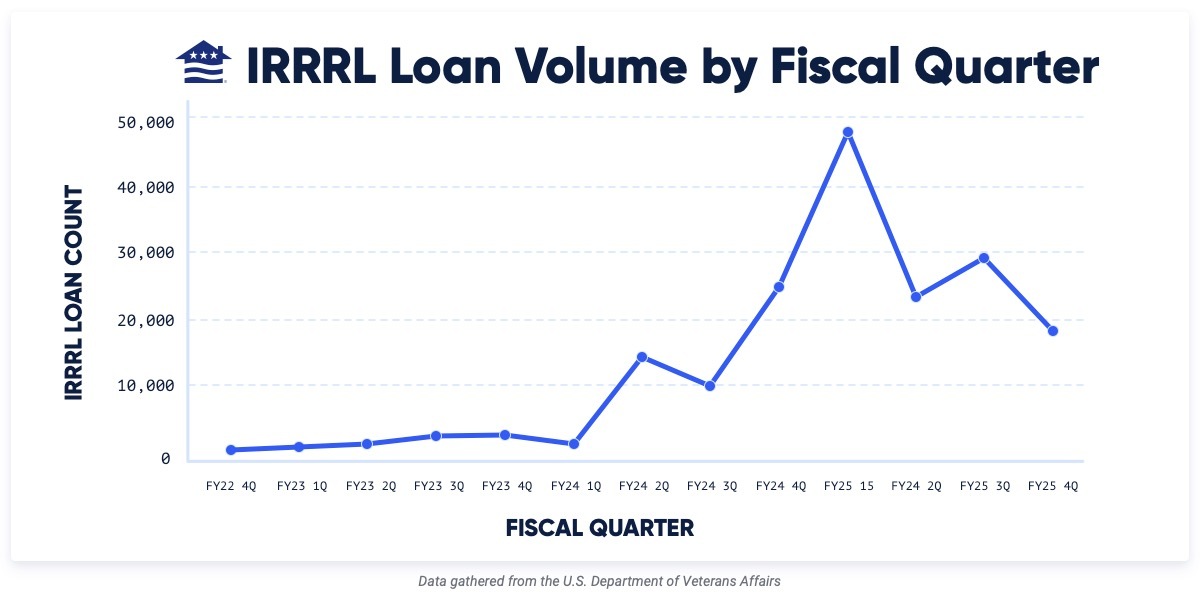

More Veterans Turned to the IRRRL Benefit in 2025, Up 135% Year Over Year

IRRRL usage among Veterans has surged 135% year-over-year, reflecting how more homeowners are turning to this option to lower rates or secure fixed terms.

After refinance activity slowed from the low-rate surge during the COVID-19 era, IRRRLs hit a low of only 285 refinances in the fourth quarter of FY2022 (fiscal year 2022).

But with the 2025 Federal Reserve rate cuts, IRRRLs made a strong comeback — totaling 119,459 loans in FY2025, more than double the 50,826 completed in FY2024.

VA Streamline IRRRL Requirements

You may be eligible for a VA IRRRL if you meet the following guidelines:

- Existing VA loan: The IRRRL is only available for properties that were originally financed with a VA loan. Borrowers with non-VA loans cannot use this option but may explore the VA Cash-Out refinance option.

- Previous occupancy of the home: You only need to certify that you currently live or have previously lived in the home. Unlike VA purchase loans, there is no requirement to occupy the property as your primary residence.

- Flexible income and employment requirements: Income verification is typically not needed unless the new mortgage payment increases by more than 20% or there are concerns about income stability. Lenders may still ask for a two-year employment history.

- Net tangible benefit: The VA requires all refinances to result in a tangible benefit for the borrower, such as a lower interest rate, lower monthly payment or move from an adjustable to fixed rate mortgage. Lenders may also have restrictions on how long it will take to recoup the costs and fees associated with the new loan.

- Loan seasoning: Lenders may require you to hold your current VA loan for a minimum period and make at least six months or 210 days of payments before qualifying for an IRRRL.

- Maximum loan term: The new loan's term cannot exceed the original VA loan term plus 10 years, with a maximum limit of 30 years and 32 days. For example, a Veteran refinancing a VA loan with a 15-year term could have a maximum 25-year term on the IRRRL.

In most cases, appraisals and credit underwriting are not required for a VA IRRRL to streamline the process. However, credit score, appraisal and loan-to-value requirements may vary depending on the lender.

Veterans United VA IRRRL Requirements

Veterans United offers VA IRRRLs to homeowners who have made at least six full, consecutive monthly payments on their original loan and waited at least 210 days since their first payment. Borrowers must also have no 30-day late payments on their current mortgage within the past 12 months.

For documentation, you’ll typically need to provide a copy of your original loan note or the final Closing Disclosure, your most recent mortgage statement and a verification of mortgage (VOM). If a standard VOM isn't available, alternatives showing six on-time payments may be acceptable.

The current loan-to-value (LTV) cap is 110% for certain VA Streamline refinances, including the financing of all closing costs, prepaid escrow funds and the VA Funding Fee. For VA IRRRLs on an Energy Efficient Mortgage (EEM), the LTV limit includes the energy-efficient improvements but not the VA Funding Fee. LTV ratios are simply the mortgage amount compared to the appraised value.

We require borrowers to recoup their closing costs within 36 months, not including escrow funds. That means the monthly savings from refinancing must add up to more than what it cost to do the refinance within three years.

Appraisals are typically only required when the loan amount exceeds $1 million. Employment is verified, but updated pay stubs are generally unnecessary if the borrower is still employed and current on their mortgage. A hard credit pull is often not required for loans Veterans United already serviced.

VA IRRRL Pros and Cons

| Pros of VA Streamline Refinance | Cons of VA Streamline Refinance |

|---|---|

| Potential for lower mortgage payment | Will need to wait for rates to drop below your current rate |

| No appraisal | No cash-out at closing |

| Doesn’t require credit check | Will still need to pay closing costs |

| Fast closing time | |

| Option to change loan terms | |

| Lower VA Funding Fee than purchase loans |

VA Streamline Refinance and the VA Funding Fee

The VA Funding Fee is an upfront fee applied to every purchase and refinance loan. Proceeds from this fee are paid directly to the Department of Veterans Affairs and are used to help cover the cost of the program.

The good news is that the VA Funding Fee is lower on IRRRLs than for typical VA purchase and cash-out loans. Borrowers who are not exempt pay a 0.5% funding fee on their IRRRL and can roll the fee into the loan balance.

Estimate the cost of your funding fee with our VA Funding Fee calculator.

Homeowners who receive compensation for a service-connected disability, qualified surviving spouses and select others are exempt from the funding fee.

Keep in mind that refinancing may result in higher finance charges over the life of the loan.

IRRRL Program FAQs

Let’s walk through some of the most common questions about VA IRRRLs and what homeowners can expect throughout the process.

What Does IRRRL Stand for?

IRRRL stands for Interest Rate Reduction Refinance Loan. It's also referred to as the VA Streamline refinance.

Who Can Be on an IRRRL?

Generally, the borrowers on the original VA loan need to be on the new IRRRL unless the death or divorce of an applicant occurs. Lenders usually can't remove a currently married or separated spouse from the new loan if they're obligated on the old one.

How Much VA Entitlement Do I Need for an IRRRL?

VA IRRRLs are unique in terms of VA loan entitlement. Getting an IRRRL does not require the use of a new or additional entitlement. Whatever amount of VA loan entitlement was used to secure the original purchase loan remains the same for the new loan, regardless of the loan amount.

Having a higher or lower loan amount on the IRRRL can affect the guaranty amount, which reflects how much lenders would recoup in the event of default. But it cannot affect the amount of a Veteran’s previously used entitlement.

Is Cash-Out Allowed With an IRRRL?

An IRRRL is generally a form of refinancing where no cash-out is allowed. However, as much as $6,000 in additional money may be borrowed to cover the cost of qualified energy efficiency improvements completed within 90 days before closing. Ask your lender for details.

What Are IRRRL Closing Costs?

Closing costs and fees for a VA IRRRL can vary by lender, but typically range from 3% to 5% of the loan amount. Borrowers can typically roll these into the final loan amount instead of paying the costs upfront. Ask your lender for details or talk with a Veterans United loan specialist at (208) 580-0051.

Can I Refinance a 30-Year Mortgage to a 15-Year With an IRRRL?

Refinancing to a 15-year mortgage is entirely possible and very common. The lifetime interest cost of a shorter loan will be less than a 30-year mortgage. However, the monthly payments on a 15-year mortgage can be significantly higher.

Look at both the monthly payments and lifetime interest costs to see if a mortgage with a shorter term makes sense.

Homeowners should understand that refinancing may result in higher finance charges over the life of the loan.

Getting Started on a VA Streamline Refinance is Easy

- NO No appraisal needed in most instances

- NO No requirement to currently occupy the home

- NO No requirement for out-of-pocket costs

1 Our military advisors are paid employees of Veterans United Home Loans.