- A VA loan preapproval sets your budget and strengthens your offer with a preapproval letter.

- VA loan preapprovals typically last 60 to 90 days.

- Improve your chances of preapproval by maintaining steady income, good credit and low debt.

Mortgage preapproval is incredibly important in today’s homebuying market. Taking the time to get preapproved shows sellers and real estate agents that you’re a committed and qualified homebuying candidate.

Some listing agents and sellers won’t even accept a purchase offer from buyers without a copy of their preapproval letter. Let’s cover everything you need to know about getting preapproved for a VA home loan.

What is Preapproval for a VA Loan?

Preapproval is an essential step in the VA loan process that goes beyond prequalification. It provides a more detailed assessment of your financial situation and confirms how much you are qualified to borrow based on verified documentation.

You can think about VA loan preapproval as a “green light” to start your homebuying journey.

Preapproval helps lenders achieve three main goals:

- Assess the borrower’s VA loan eligibility

- Initially verify the borrower’s financial qualifications, including credit, income and debt.

- Issue a preapproval letter and detail the homebuyer’s purchasing power

Preapproval provides buyers with a clear understanding of their purchasing power and the steps needed to reach closing day. However, keep in mind that preapproval isn't a guarantee of financing.

With preapproval, you'll have a realistic view of what you can afford, enabling you to make a strong offer without stretching yourself too thin.

I would strongly encourage other Veterans to get preapproved. Without it, they might fall in love with a home that’s outside their budget, leading to disappointment. Knowing their price range upfront helps them focus on homes they can afford, saving time and avoiding financial stress.

Preapproval vs. Prequalification

Preapproval is a more detailed process than prequalification. Other than pulling your credit reports, lenders basically rely on your word and your best estimates of what you can afford during the VA loan prequalification conversation.

During the preapproval process, lenders want to verify information. You’ll typically need to provide financial documents like pay stubs and bank statements and sign non-binding forms and paperwork. Lenders will be looking at cold, hard numbers and creating the most realistic picture possible of your purchasing power.

You can make the process faster and easier for everyone by returning any requested paperwork promptly.

4 Steps to Get Preapproval for a VA Home Loan

Preapproval is easier to achieve than you might think. By breaking it down into four simple steps, you can navigate the process with confidence and stay on track toward buying your new home. Here’s how to get preapproved for a VA loan.

1. Meet the VA’s Eligibility Requirements

To qualify for a VA loan, you must meet the minimum service requirements set by the Department of Veterans Affairs. However, there are exceptions for those discharged with a service-related disability, eligible surviving spouses and other situations.

You may need to obtain a Certificate of Eligibility (COE) to verify your VA loan eligibility. While this document isn’t required to get preapproved for a VA home loan, you will need it when it’s time to close. Many VA lenders can easily help you retrieve your COE early on in the process to avoid any delays or confusion. At Veterans United, we can access the Automated Certificate of Eligibility (ACE) database and often get your COE in seconds.

2. Check Your Finances and Prepare Documents

While VA loans don’t have a minimum credit score, most lenders, including Veterans United, look for a median credit score of 620 or higher. It’s a good idea to request a copy of your credit report, review it for accuracy and dispute any errors that could impact your score before applying.

Lenders will also consider any major recurring debts that could affect your ability to make your monthly mortgage payments. The VA doesn’t set a specific debt-to-income (DTI) ratio but instead guides lenders to look for a healthy balance between monthly debt and monthly income. If your DTI exceeds 41%, you may need to meet additional compensating factors to qualify.

VA borrowers also must meet residual income requirements and have enough money left over each month to cover living expenses and maintain financial stability.

After your finances are in order, you should gather any paperwork. Below is an overview of the documents you may need to provide or give a lender permission to obtain during VA preapproval:

Required Documents For VA Loan Preapproval

| Document | Why It’s Needed |

|---|---|

| Government-issued photo ID | Confirms your identity (typically a driver’s license). |

| Form DD-214 | Verifies your military service. National Guard and Reserve Veterans may need points statements or similar paperwork. |

| Statement of service letter | Proves current status for active duty service members; must be signed by a commanding officer. Talk with your loan officer for more details. |

| Recent pay stubs and W-2 forms | Shows proof of income for the last two years. |

| Federal tax returns | May be required if you earn self-employment income, 1099s or rental income; must cover the last two years. |

| Recent bank statements | Demonstrates your financial stability and available funds. |

| VA awards letter | Confirms VA disability percentage and monthly income amount. |

| Social Security awards letter | Verifies monthly income from Social Security, if applicable. |

| Retirement account statement | Provides proof of retirement savings and account balances. |

| Divorce decree or court orders | Documents alimony or child support obligations, if applicable. |

| Child care statement | Explains child care costs or states why no child care expenses apply. |

3. Choose a VA-Approved Lender and Apply

Working with a lender who specializes in VA loans is essential. Experienced lenders understand the unique requirements and benefits of these loans and can guide you through the process. They help you meet eligibility criteria and maximize your benefits — something standard lenders may not be as experienced with.

Veterans United has been the top VA purchase lender for the last nine consecutive years and can help you navigate the VA loan process with ease to secure your dream home.

It’s important to evaluate and compare various lenders by reviewing interest rates, fees and customer reviews to find the best fit for your financial needs and goals. This extra effort can help secure favorable terms and a smoother path to homeownership.

Most VA lenders rely on an “Automated Underwriting System,” or AUS, to determine a buyer’s preapproval status. An AUS is a computer program that instantly evaluates a buyer’s eligibility based on a variety of factors.

Not every qualified borrower will obtain AUS approval. In those cases, lenders will consider a “manual underwrite,” which is a more involved process that typically utilizes more stringent requirements.

VA Home Loan Payment Calculator

4. Receive Your VA Preapproval Letter and Start Home Shopping

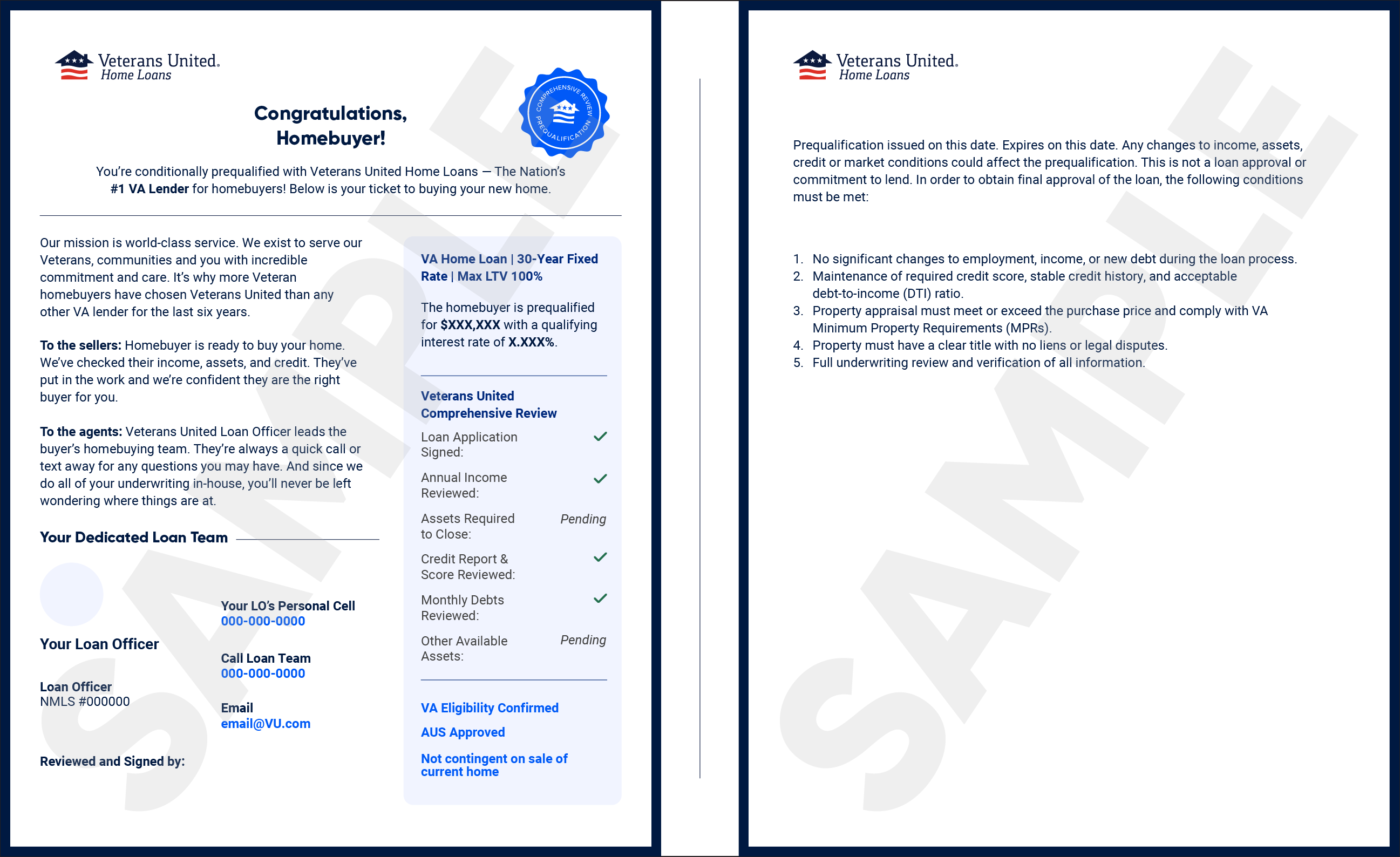

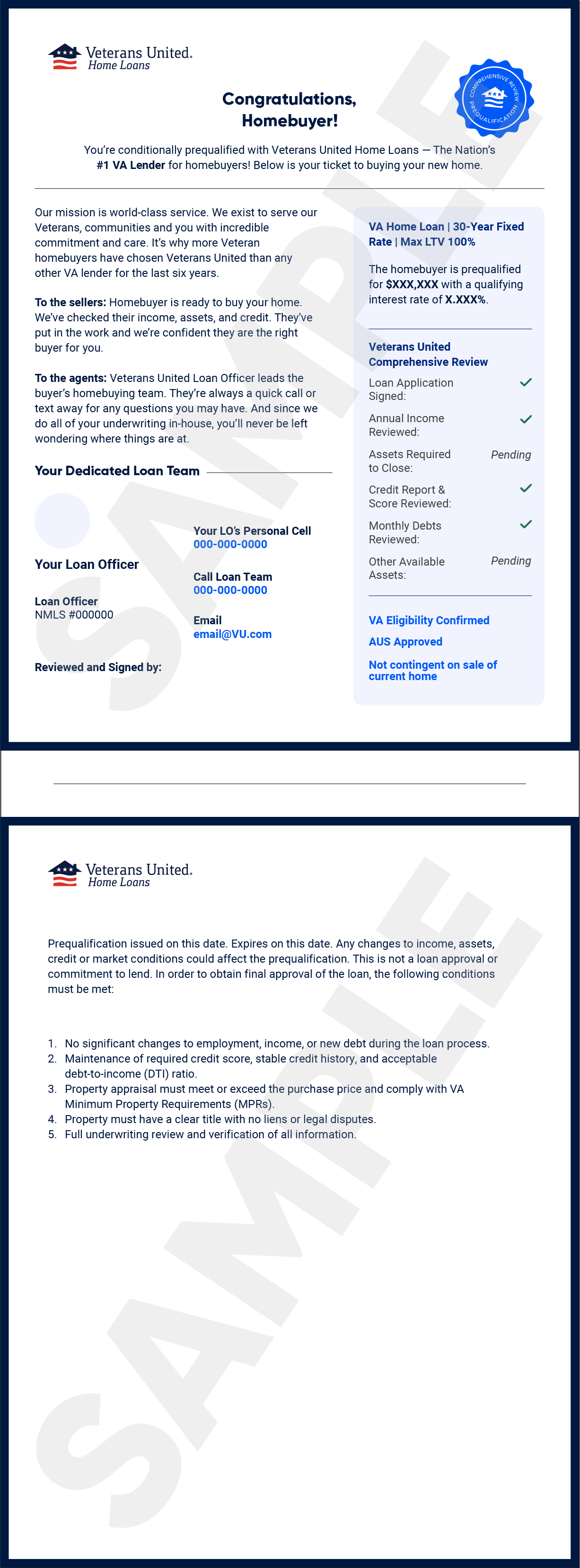

Once you’ve been preapproved for a VA loan, you will receive a “preapproval letter.” The letter confirms the loan amount you’re preapproved for, providing you with a clear budget and demonstrating to sellers that you’re a serious buyer.

Sometimes a preapproval letter will list a series of conditions that need to be met in order for the loan to move forward. These conditions help protect both lenders and borrowers in case things don’t go as planned or financial circumstances change.

Below is an example of what a VA preapproval letter might look like. While the exact format and details may vary by lender, this example provides an idea of the key information typically included.

With your preapproval in hand, you can confidently start shopping for homes within your price range. Be sure to share your preapproval letter with your real estate agent to streamline the offer process.

Remember, preapproval is not a guarantee of final loan approval, so avoid major financial changes while searching for your dream home. Opening a new line of credit to buy the boat you’ve always wanted might tank your chances of buying a home, even if you’ve already received your preapproval letter.

How Long Does it Take to Get Preapproved for a VA Loan?

You may be able to get preapproved for a VA loan in just a few minutes, especially if you apply online. In most cases, you can expect to receive your VA loan preapproval within a week.

However, the timeline can vary depending on your lender and how quickly you provide the required documentation. Having your financial paperwork ready (pay stubs, tax returns and bank statements) can help speed up the preapproval process.

We had a very short timeframe to complete the process due to the buyers, which added a lot of pressure. Thankfully, Veterans United not only worked with us but also helped navigate challenges like the inspection and other issues along the way. At one point, we thought we might have to walk away from the home and weren’t sure what our options were, but our loan officer provided solutions we didn’t even know were possible, which made all the difference.

How Long is a VA Preapproval Good For?

VA loan preapprovals typically don’t have strict expiration dates, but most lenders prefer them to be no more than 60 to 90 days old to ensure the information is current and accurate. After this period, lenders may find it necessary to look at your finances again to confirm your preapproval letter accurately reflects your purchasing power.

Most preapproval letters also clarify that changes to your credit, income or other important financial metrics can cause the document to expire. Again, loan preapproval is not the same thing as formal loan approval. It’s also not a binding step. You can seek preapproval from multiple lenders.

Some lenders may allow you to alter the date and the preapproval amount (up to your max) in order to craft a strong offer without tipping your hand. You might be preapproved for a $500,000 loan, but it may not be in your best interest for home sellers to know how high you can go.

How to Increase Your Chances of Getting Preapproved For a VA Home Loan

A strong financial foundation can significantly increase your chances of getting preapproved for a VA home loan. While VA loans don’t typically require a down payment and are designed to accommodate a wide range of financial situations, taking proactive steps to improve your financial profile can make the process smoother and help you secure better terms.

Here are some VA loan preapproval tips to consider:

- Pay off small debt: Reducing your outstanding debts can lower your debt-to-income ratio and improve your overall financial health. Paying off smaller balances, such as credit card debt, can free up monthly income and make you more appealing to lenders.

- Avoid major financial changes: Maintain financial stability during the preapproval process. Avoid making large purchases, opening new lines of credit or switching jobs, as these changes can impact your credit score and debt-to-income ratio.

- Improve your credit score: Take steps to boost your credit score by paying bills on time, reducing credit utilization and addressing any errors on your credit report. A higher credit score not only helps with preapproval but may also qualify you for better interest rates.

Credit experts at Veterans United work with Veterans, service members and their families for free to develop a plan to repair their credit and get on the path to loan preapproval. They’ve helped more than 100,000 people go on to boost their credit and close on a home loan.

Improving your financial health not only enhances your chances of preapproval but also positions you for long-term financial success as a homeowner.

If you have any questions or would like to start your own VA preapproval, talk with a Veterans United VA loan expert at 855-870-8845 or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Dec 15, 2025

Written ByChris Birk

Reviewed ByTara Dometrorch

Added insight about the VA loan preapproval process from Associate Directors of Production. Article reviewed by team lead underwriter Tara Dometrorch.

May 1, 2025

Written ByChris Birk

Reviewed ByTara Dometrorch

Major updates to content to improve understanding and tips that include borrower quotes and a sample VA loan preapproval letter. Article fact checked and reviewed by team lead underwriter Tara Dometrorch.

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.