Whether it's your first time or you’re a seasoned homebuyer, it can be stressful to navigate the house-hunting process. Fortunately, we’ve made a free house-hunting checklist to keep you organized throughout this monumental task. Let’s dive into what to look for when house hunting.

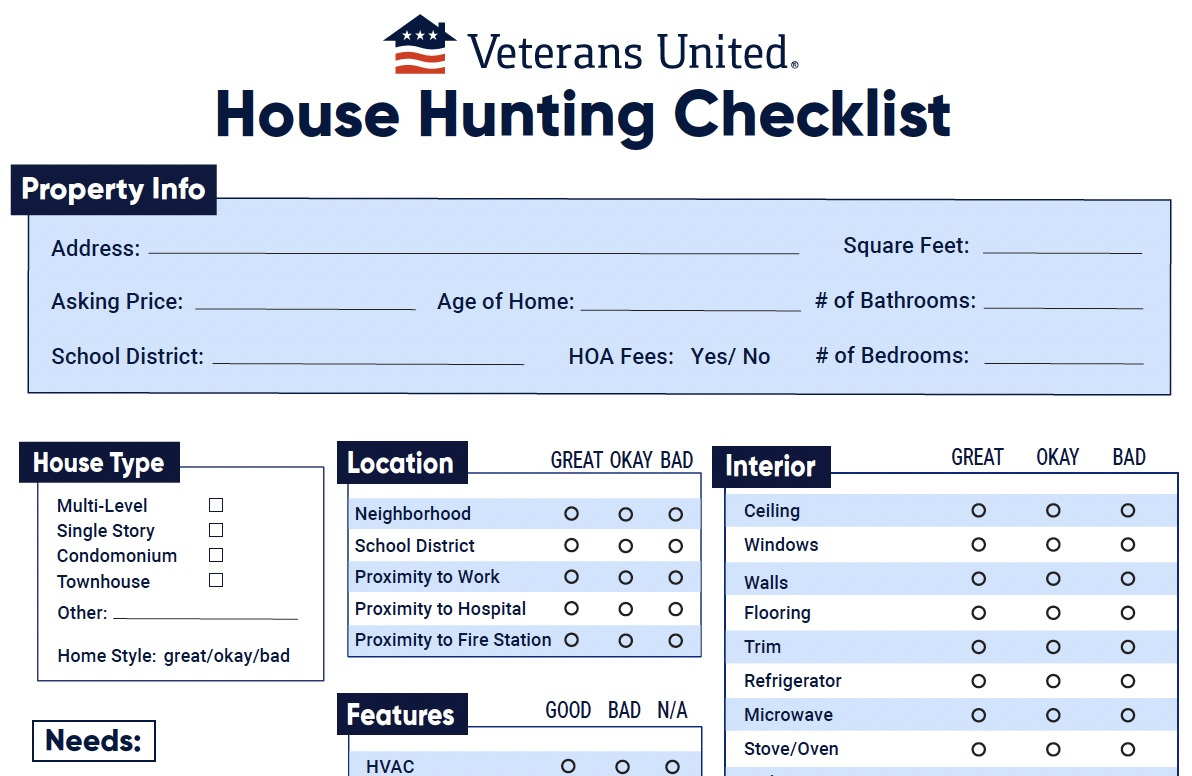

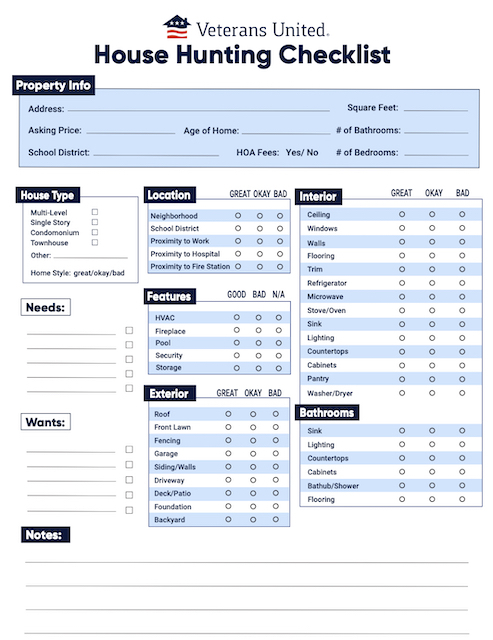

House Hunting Checklist

You shouldn’t have to strain your brain to remember every home’s detail. Download our free house-hunting checklist so you can prioritize your needs and wants, stay organized and remain focused on your vision of a dream home. Click the link or the image to download the full version of this checklist.

Choose Your Wants, Needs and Must-Haves

Distinguishing between wants, needs, and must-haves in a house can help you prioritize your preferences and make informed decisions during the homebuying process.

Wants

Think Desirable but Not Essential: Wants are features or amenities that would enhance your quality of life but are not crucial for daily living. These can include items like an updated kitchen, a home office, or a swimming pool.

Needs

Think Essentials: Needs are non-negotiable elements that a house must have to meet your basic requirements. These typically include factors like the number of bedrooms and bathrooms, location relative to work or schools, and safety.

Must-Haves

Think Most Important Priorities: Must-haves are a subset of your needs that are particularly crucial. These are the top priorities among your needs, and ensure the home meets your minimum criteria. For example, if you need a minimum of three bedrooms, a must-have might be having at least one of those bedrooms on the ground floor for accessibility reasons.

What to Look for When Buying a House

There are a few key areas you should consider when drafting your list of wants and needs for the house-hunting process:

Location and Neighborhood

When embarking on the journey of buying a new house, the first and foremost consideration is the location and neighborhood. Do you need to be in a certain school district or closer to work? Are you looking for a more urban setting, or would you rather be nestled in the suburbs?

The location should ideally be convenient in terms of your daily commute to work and access to essential services like schools, grocery stores, and healthcare facilities. Take the time to research the neighborhood's safety and crime rates to ensure you and your family will feel secure in your new home. If you have children or plan to in the future, the quality of the local school district is of paramount importance. Additionally, consider the future development plans for the area, as this can impact property values and your overall quality of life.

Also, keep in mind that property taxes and homeowners insurance costs can vary depending on the location, and those can have a real impact on your homebuying budget.

House Size and Type

The size and type of house you choose are significant factors in your decision-making process.

Determine how many bedrooms and bathrooms you need to comfortably accommodate your family. It's essential to evaluate the layout and flow of the house to ensure it suits your lifestyle and preferences. Think about the long term as well. Does the house have the potential to adapt to any future family expansions or lifestyle changes you might anticipate? Planning ahead can save you from outgrowing your home too quickly.

You might need or want a basement or rec room if you have older kids or teenagers. Are you set on a single-family home, or are you open to condos and townhouses? Maybe you’re not interested in two-story homes or large lots, which then fall in the category of “deal breakers.”

Yard Size

The yard size is an often underestimated aspect of a house that can significantly affect your quality of life.

Do you need a big yard for kids or pets? Some buyers want room for a garden or to have some privacy from neighbors. Others hate the idea of spending weekends on a lawnmower or with a rake in hand. The average new single-family home is built on about 14,000 square feet (about a third of an acre), according to the National Association of Home Builders. You may want more or less. Hiring someone to mow your yard could be pricey, and doing your own lawn maintenance requires tools and time.

Amenities

Home amenities are the special things in a house that make it more comfortable and useful.

And it’s usually where the “want” floodgates open.

Here are some common home amenities for you to consider:

- A master bedroom with an adjoining bathroom

- Fireplace

- An updated kitchen with granite countertops and stainless steel appliances

- Hardwood floors

- Updated bathrooms

- Walk-in closet

- A patio or deck

And it’s okay to want all of this and more. But try to prioritize all those amenities and features and determine if any are true needs. If you’re passionate about woodworking or some other hobby, you might need a dedicated workspace in a basement or a garage.

The key is to be honest and open with yourself. You also have to be flexible. It’s not uncommon for both needs and wants to change as you look at more homes. Amenities you thought were essential might become less so the more properties you see. On the other hand, something that started out as a “want” might move into the “need” category as the home tours roll on.

Time Spent in Home

The average homebuyer expects to live in their home for about 14 years, according to the National Association of Realtors. But everyone’s situation is different.

If you're planning to stay in the house for only a few years, you may prioritize features and amenities that enhance its resale value. However, if it's a long-term investment, think about how the home can adapt to your changing needs, such as a growing family. Always consider potential life changes and how the house can accommodate them.

If you’re a service member likely to PCS a few years after purchasing, your wants and needs might be a lot different than someone planning to stay in the home longer. If you’re likely to move in the coming years, schools can be important even if you don’t currently have school-age children. Many future buyers will have good schools high on their shopping lists. Factor in your short- and long-term goals and plans when you’re thinking about wants and needs.

Budget

Setting a budget is a fundamental step in the homebuying process. Begin by evaluating your financial situation, including your down payment, ongoing mortgage payments, property taxes, and homeowners insurance. Be realistic about what you can comfortably afford while maintaining your lifestyle.

Keep your loan preapproval and your housing budget at the forefront.

Red Flags When Buying a House

While it’s important to have your wants and needs in mind, it’s just as important to keep an eye out for potential issues when you’re touring homes.

Here's a list of red flags to watch out for when buying a house:

- Structural issues: Cracks in walls, uneven floors, or sagging ceilings can be signs of structural problems that might require expensive repairs.

- Water damage: Stains, mold, or a musty smell could be indicators of water damage, which may suggest plumbing issues, leaks, or poor drainage.

- Pest infestations: Keep an eye out for signs of pest infestations, such as droppings, chewed wood, or insect activity, which can lead to costly pest control measures.

- Inadequate insulation: Poor insulation can result in high energy bills and discomfort. Check for drafts, cold spots, or inadequate insulation in the attic and walls.

- Unusual odors: Foul or persistent odors, such as sewage, mold, or strong chemical smells, can indicate underlying issues that need addressing.

Some home loan types, like the VA loan, require buyers to get an appraisal and order pest inspections (depending on where you live). Even if your lender doesn’t require it, pest and home inspections are great ideas for all buyers to give you peace of mind and protect your investment.

Remember to prioritize your needs, be patient, and utilize the wealth of resources available to you, from online listings to real estate agents. By staying organized, you'll be well-equipped to find a home where you can create cherished memories for years to come.

Happy house hunting!

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.